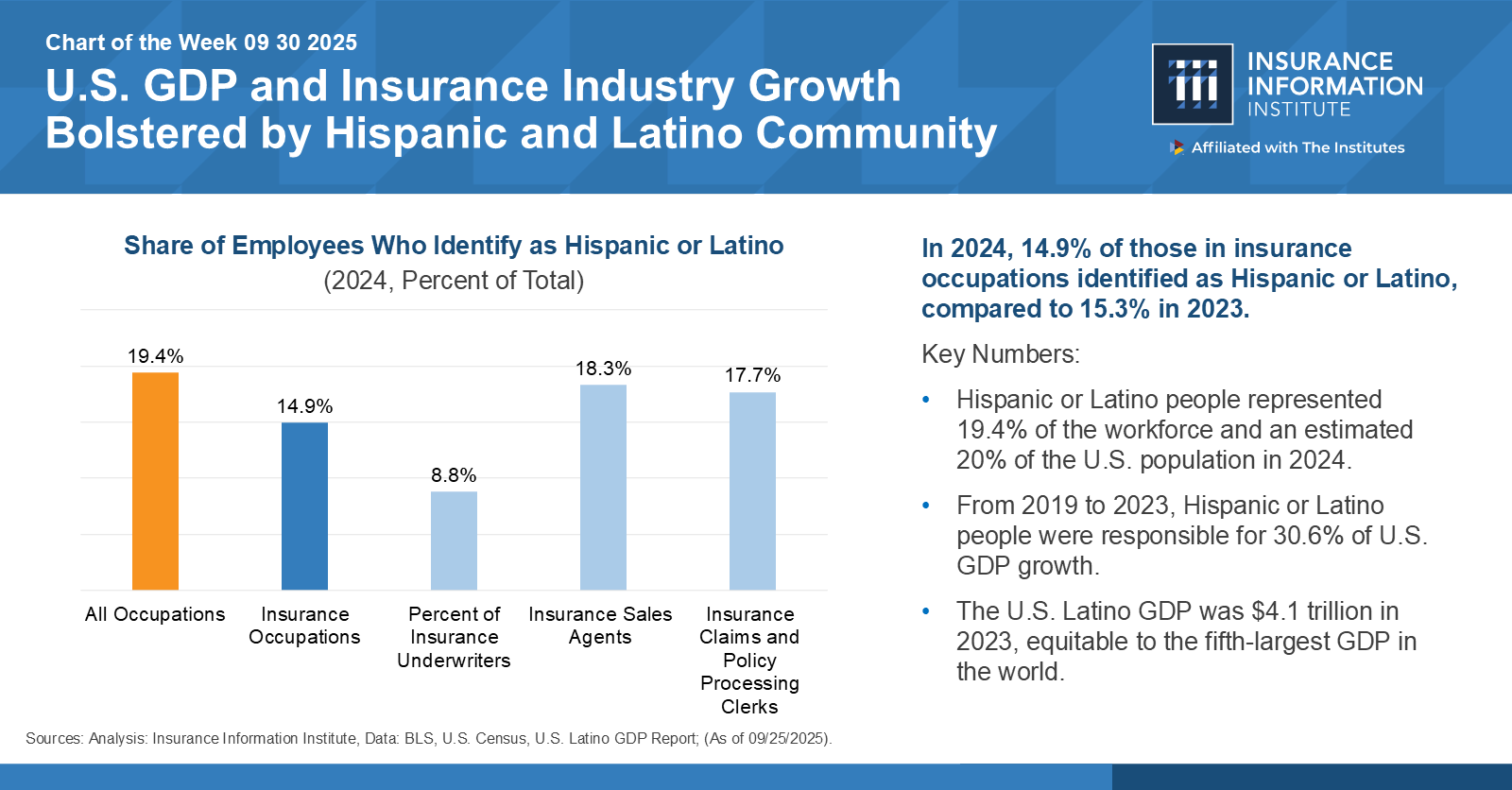

Whilst Latinos proceed to play an important position within the U.S. financial system, Latino illustration of insurance coverage trade employees fell barely in 2024, to 14.9 %, from 15.3 % in 2023, in accordance with a latest Triple-I “Chart of the Week”. The best illustration of this demographic was 18.3 % of insurance coverage gross sales brokers, with claims and coverage processing clerks following carefully, at 17.7 %. The bottom illustration was amongst underwriters, at 8.8 %.

The chart — “U.S. GDP and Insurance coverage Business Development Bolstered by Hispanic and Latino Group.” — relies on information from the Bureau of Labor Statistics and the U.S. Latino GDP report.

From 2019 to 2023, Latinos drove 30.6 % of U.S. GDP development regardless of making up solely about 20 % of the general U.S. inhabitants (by 2024) and 19.4 % of the workforce. Latinos generate a GDP of $4.1 trillion by 2023 (up from $3.7 trillion in 2022), enough to rank alone because the fifth-largest GDP on this planet. The Latino client market, with $2.7 trillion in consumption in 2023, has a shopping for energy bigger than the economies of powerhouse states comparable to Texas ($2.58 trillion) and New York ($2.17 trillion).

The Nationwide Affiliation of Hispanic Actual Property Professionals predicts that Latinos would be the largest group of homebuyers within the nation by 2030. Homeownership for this group is 9.8 million households, with 238,000 new Latino proprietor households added in 2023 alone —the biggest improve of any racial or ethnic group for the second consecutive yr. Information evaluation signifies there could also be greater than 30 million new Latino drivers hitting the roads by 2050. Latinos are additionally the fastest-growing group of entrepreneurs, in accordance with the Stanford Latino Entrepreneurship Initiative.

Successfully participating this formidable market creates immense alternative for the insurance coverage trade. Nonetheless, solely simply over half of the respondents to a survey carried out by Marsh and the Latin American Affiliation of Insurance coverage Businesses (LAAIA) stated they believed their corporations have been invested in attracting Hispanic clients. Almost two-thirds of respondents stated insurers don’t make use of sufficient Latinos. Solely 14 % thought insurers employed an sufficient quantity. Furthermore, 84 % agreed that Latinos are underrepresented within the senior administration of most insurance coverage corporations.

Efforts to create a various and inclusive workforce can drive larger shopper satisfaction and loyalty. As Amy Cole-Smith, Govt Director for BIIC/ Director of Range at The Institutes, has identified, “this isn’t nearly fairness —it’s about unlocking development and staying aggressive in a altering market. When the insurance coverage workforce displays the range of the market, we’re in a stronger place to construct merchandise that meet individuals the place they’re.”