Key Takeaways

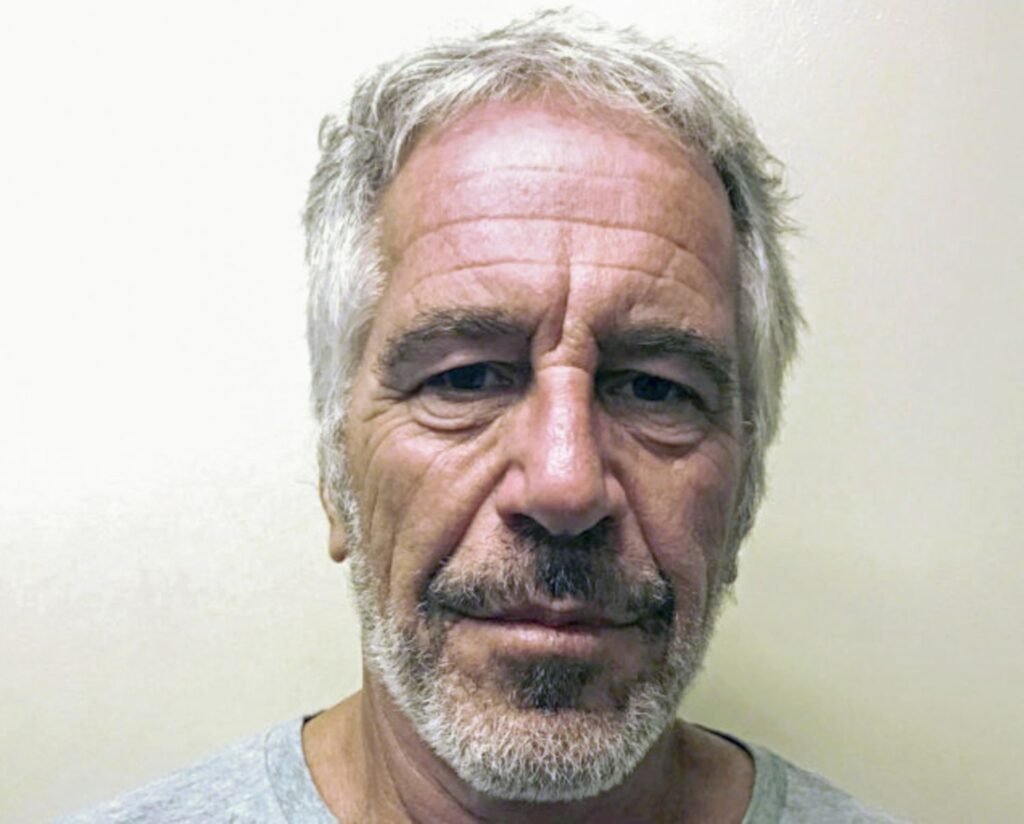

- Jeffrey Epstein died with an estate worth about $600 million, but the exact source of his wealth remains murky, helping to fuel the many conspiracy theories around him.

- His largest reported clients—Leslie Wexner and Leon Black—paid him hundreds of millions of dollars for tax and estate planning services.

- A $40 million investment in Peter Thiel’s Valar Ventures later grew to nearly $170 million, becoming the largest asset in Epstein’s estate.

When people hear the name Jeffrey Epstein, they usually think of scandal, crimes, and powerful connections. But one of the biggest mysteries surrounding the disgraced financier is how he made his money.

At the time of his death in 2019, Epstein’s estate was valued at nearly $600 million, yet few clear records explain how a former prep school teacher and Wall Street trader built such vast wealth. What is known is that a handful of billionaire clients—most notably retail magnate Leslie Wexner and private equity tycoon Leon Black—paid him extraordinary sums for tax and estate planning. Beyond that, Epstein’s opaque businesses, offshore dealings, and questionable associations leave lingering questions about what was really going on behind the scenes.

From Private School Teacher to Wealth Manager

After a short stint as a math teacher at New York’s Dalton School, Epstein moved to Wall Street in the 1970s, working as an options trader and later as a limited partner at Bear Stearns. In the early 1980s, he launched his own wealth management business, eventually operating out of the U.S. Virgin Islands, where secrecy laws shielded many details of his work.

According to The New York Times, Epstein marketed himself as a math whiz and “financial doctor” who specialized in helping the wealthy reduce their tax bills. Epstein’s most famous client was Leslie Wexner, the billionaire retail magnate behind Victoria’s Secret and Bath & Body Works. What made their relationship unusual was that Wexner gave Epstein power of attorney—legal authority to make financial and business decisions on his behalf. That meant Epstein could sign checks, buy and sell properties, and even borrow money in Wexner’s name. That is an extraordinary level of trust to place in someone with what was then a relatively short professional track record.

Another major client was Leon Black, co-founder of Apollo Global Management, who paid Epstein more than $150 million for tax and estate planning advice. Those payments were far higher than what wealthy individuals typically spend on such services, raising further questions about why clients would pay Epstein such a premium for his work.

Fast Fact

Epstein was a convicted sex offender who first pleaded guilty in Florida in 2008 to soliciting prostitution from a minor. He was arrested again on federal sex-trafficking charges in July 2019, but died by suicide in a Manhattan jail a month later while awaiting trial.

Shady Dealings?

Most successful money managers operate with some degree of transparency—meaning clients, regulators, and sometimes the public can see how their firms earn fees and manage investments. Not Epstein. His company operated in the Virgin Islands, where it’s okay for people like Epstein to keep their financial dealings secret.

The little that is known has fueled speculation. Aside from his connections to Wexner and Black, Epstein rarely disclosed other clients or the services he provided. This lack of visibility, combined with unusually large fees and his personal control over Wexner’s fortune, has led many observers to wonder whether Epstein’s financial dealings went beyond standard money management.

Wexner

Epstein’s unusual relationship with Wexner was central to his wealth. His hold over his biggest reported client has long raised questions. Within a few years of meeting, the billionaire granted Epstein the power to manage his businesses and finances as he saw fit. He also reportedly gifted Epstein a lavish $77 million townhouse in New York City, and other perks, including the use of a private jet.

Fast Fact

Epstein labeled himself a financier—someone who manages large sums of money for wealthy clients, typically focusing on investments, tax strategies, and estate planning. In Epstein’s case, that meant handling billions for clients like Wexner.

Ponzi Scheme

Epstein was also linked to Towers Financial, a company later exposed as one of the largest Ponzi schemes in U.S. history. A Ponzi scheme is a type of fraud in which money from new investors is used to pay earlier investors, creating the illusion of real profits when none exist.

Steven Hoffenberg, Towers’ founder, described Epstein as his “wingman” in the operation, which ultimately cheated investors out of hundreds of millions of dollars. Epstein was never charged in the case, but the association added to suspicions about how he did business.

Investments

Epstein also made money legitimately from investing. A list of every investment he made isn’t available, although we do know that the largest asset held by his estate, as of July 2025, was two funds managed by Valar Ventures, a firm co-founded by Peter Thiel that specializes in providing startup capital to financial technology companies.

That investment, which cost Epstein $40 million in 2015 and 2016, is now worth nearly $170 million.

Tax Breaks in the Virgin Islands

A major source of Epstein’s wealth came from the tax incentives he secured in the U.S. Virgin Islands. Starting in the late 1990s, Epstein set up companies there that qualified for the territory’s Economic Development Program, which offered massive tax cuts—up to a 90% cut in corporate income tax and full exemptions from some local taxes.

To qualify, firms had to employ local residents and invest in the community. Epstein reportedly saved more than $300 million in taxes between 1999 and 2018 from the program, allowing him to keep far more of his earnings than he would have on the U.S. mainland.

The Bottom Line

Epstein died a wealthy man, with an estate worth nearly $600 million. He built that fortune, it seems, primarily from fees earned from just a few clients, as well as tax breaks that saved him several hundred million over two decades. He also left behind investments that continue to grow in value, most notably a stake in Peter Thiel’s Valar Ventures.