Ashley:

Among the best components of this present is that we get to reply actual questions from rookies who’re within the trenches proper now.

Tony:

Yeah. And right this moment’s questions are everywhere in the map from the place to stash your rental revenue. So it’s truly incomes you one thing to the best way to discover offers in a tricky market like Chicago to working numbers on a $700,000 short-term rental.

Ashley:

And the cool half is these are the identical sorts of challenges that rookies all over the place are dealing with. Money administration, deal stream and working STR numbers the proper approach. So should you’ve ever questioned the best way to maximize your lease deposits, the best way to break right into a aggressive metropolis or what you is perhaps lacking when analyzing an Airbnb, this episode is for you. That is the Actual Property Rookie podcast. And I’m Ashley Kehr.

Tony:

And I’m Tony j Robinson. And with that, let’s bounce into our first query, which comes from Kevin within the BiggerPockets kinds. Kevin says, the place do landlords maintain rental revenue to earn curiosity earlier than bills? I’m in search of good methods to maximise curiosity on rental revenue earlier than mortgage and expense payouts. What accounts or platforms do you employ? Proper now I maintain my rental revenue in a regular checking account that doesn’t earn curiosity. On common, I herald about eight okay per thirty days in lease and spend round six and a half Okay on mortgage and bills. That leaves me with roughly 1500 bucks sitting idle every month not incomes something. I’d love to listen to how different landlords handle this. Are you utilizing excessive yield financial savings accounts, cash market accounts, or landlord particular platform to make your money work more durable between lease assortment and payouts? That is truly the cool query. I imply, we’re on episode like, I dunno, 600 and a few odd and I don’t know if anybody’s ever requested this query of the place will we put our money to make it work more durable? I assume simply fast context, when you will have cash sitting in a financial institution, if it’s in a conventional account, it’s incomes normally pennies if that

Ashley:

0.001%,

Tony:

0.001%, proper? And when you concentrate on inflation, it actually signifies that your cash is shedding worth each single 12 months that it sits there idle. So oftentimes when you have money that you already know is simply going to be sitting there, it makes extra sense to place that into some form of account that earns extra curiosity. The financial institution goes to pay you extra for leaving that cash in that account. So it’s a actually nice query. Ash, you’re clearly our resident private finance queen, so what’s your preliminary suggestion to Kevin on the place he ought to stash these funds?

Ashley:

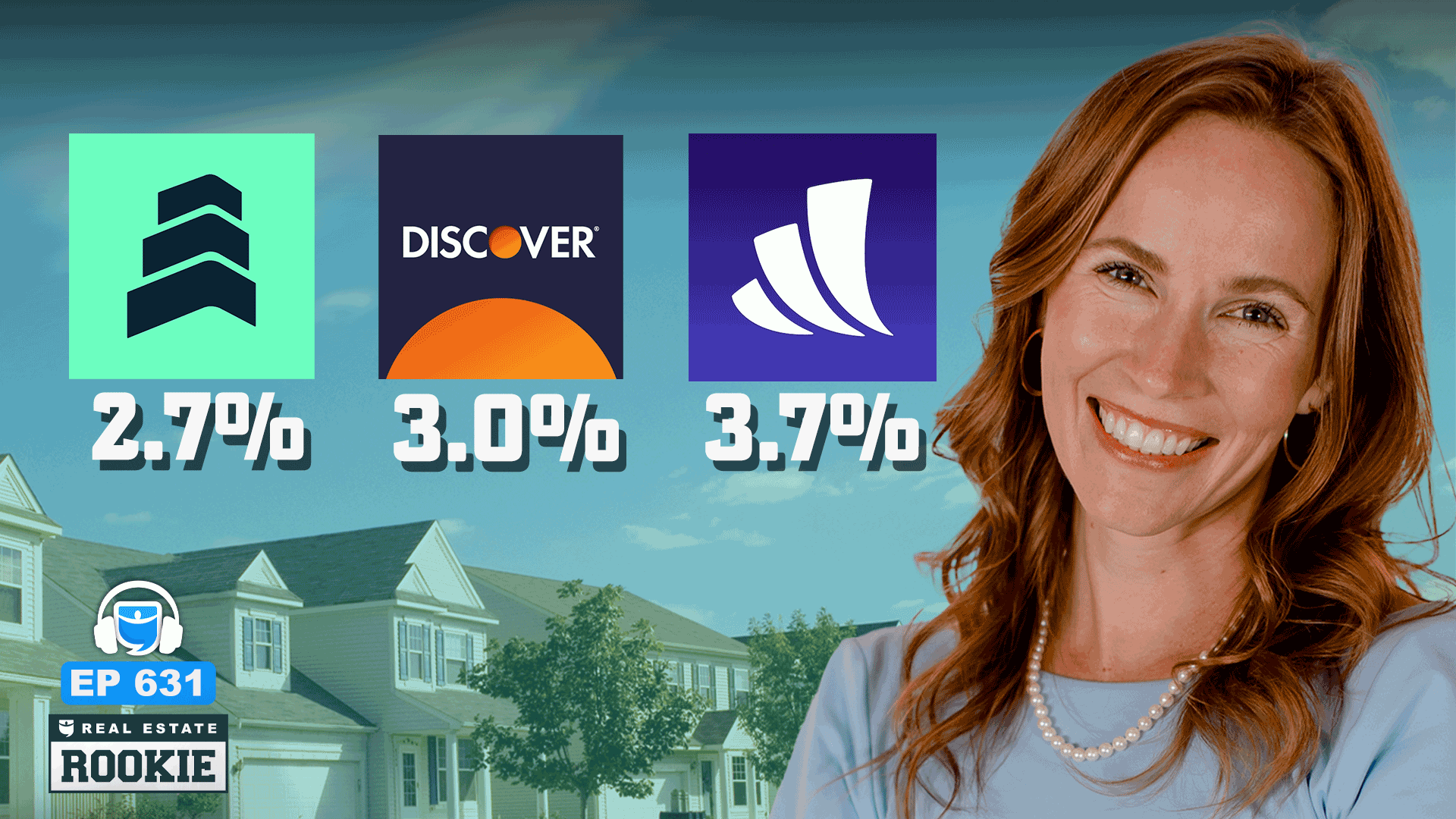

Yeah, I undoubtedly began out with a kind of 0.001% curiosity checking accounts, enterprise checking accounts for my native financial institution, and we love native banks right here, however more often than not it’s for the financing piece and never truly the money administration. So I truly made the change to Base Lane, which is definitely a banking platform constructed for actual property buyers and that is the place my tenants robotically pay their lease and it goes into that account. Additionally they have an automatic bookkeeping service known as Baseline Sensible, and that really robotically places my transactions in, so it makes my accounting and bookkeeping so much simpler. However yeah, I like and likewise they’ve the excessive yield financial savings accounts additionally. So not solely do I wish to discover a checking account that’s incomes me some cash from that prime yield curiosity financial savings account, but additionally that makes it simpler as a enterprise proprietor to really observe my revenue and bills.

There’s one financial institution that I had began with is a really small native financial institution that had 5 branches and there was no type of automation. It was actually I received my financial institution assertion within the mail each month. I couldn’t even go surfing to an internet portal and think about a verify how one can simply go and signal into your on-line banking and think about a verify as to who was written to and see the precise copy. It was a really very long time earlier than they really received something like that in place. So I undoubtedly don’t advocate a small native financial institution for your enterprise. I actually undoubtedly like a banking platform as an alternative. That’s all encompassing.

Tony:

Base lane’s an incredible possibility. We all know a number of of us which are utilizing Base Lane. I personally use Relay Monetary for all of our enterprise banking as a result of should you observe me on Instagram at Tony j Robinson, you in all probability heard me speak about Relay earlier than. Should you’re on our YouTube channel, like my thoughts and my spouse’s YouTube channel, the Actual Property Robinsons, we speak about it so much there. And the explanation that we type of stumbled into Relay, I’ll speak concerning the financial savings half, however the cause that we stumbled into Relay initially is as a result of I’m a giant fan of the Revenue First methodology for managing your Cashflow. And we’ve truly interviewed Mike Mcal was the writer of Revenue First on the podcast right here, so you may look that episode up. However Relay is definitely the one financial institution that I do know of that’s the financial institution constructed for Managing Revenue first or for implementing Revenue first, and you’ll have your whole totally different checking accounts arrange and the cash strikes robotically.

They’ve since added a number of different performance, which makes it actually nice. However along with all these cool issues about being an internet first financial institution and the cool expertise, additionally they supply fairly sturdy curiosity earn on financial savings accounts. Now clearly these, and it doesn’t matter what financial institution you’re going with, thera that you just’ll earn will differ and fluctuate normally primarily based on the Fed funds charge. So we simply had that charge come down just lately and due to that, a number of these banks that supply curiosity on their financial savings accounts have in all probability pulled their charges down. I checked out Base Land, they’re at simply over 3% relay proper now it’s just below 3% by way of essentially the most that you would be able to earn, however that’s 3% continues to be higher than 0.001% than what you’d be getting. So I feel for me simply sticking into an account like that, that’s nonetheless liquid. I wouldn’t put into one thing like even a cash market account. I feel I might be considerably nervous for as a result of there’s an excessive amount of fluctuation on a day-to-day and I wish to be sure that I can entry these funds once I want it. A CD account that’s locked up for too lengthy. So simply a few of these financial savings accounts the place you may earn a wholesome return I feel is the best choice.

Ashley:

However typically even a few of the cash market account or the CDs, the speed will not be even that significantly better than a excessive yield financial savings account. I keep in mind trying, this was in all probability 4 years in the past, 5 years in the past, I had a piece of cash that I used to be seeking to do one thing with and to place it into one thing and it was truly higher for me to place it within the excessive yield financial savings account than lock it up for six months a 12 months right into a cd. So I feel go searching, but additionally particularly in case you are, what’s the goal of that cash? So mainly I maintain all my safety deposits in there the place I’m not utilizing that cash, that cash is sitting there, but additionally if somebody strikes out, I’ve to be prepared to have the ability to take that cash out to refund their safety deposit so long as there’s no injury or something.

But when it’s your rental revenue, do it’s essential pay payments conveniently? Do you wish to have to jot down a verify each month? Would you like some type of invoice pay system? Issues like that you ought to be pondering of, would you like your lease assortment to really be deposited into that account or is that this simply your leftover cashflow that’s truly simply going to be sitting there and perhaps you’re saving for a CapEx or saving for the following deal? Issues like that. So I additionally suppose you ought to be what sort of checking account you need relying on what that cash is definitely going for use for or perhaps all of these belongings you want.

Tony:

Ashton, you convey up a very good level about evaluating the charges on a certificates of deposit, which usually should lock that cash up for some predetermined time period and the normal excessive yield financial savings accounts, and we use Ally for our private financial institution they usually’ve received I feel 3% on their financial savings accounts proper now, simply over 3%. So just about in step with what each Relay and Baseline are providing, however they’re, their financial savings account presents a 3.4% charge. Their three month CD presents a flat 3%. So that you would actually be higher off in that timeframe simply leaving your cash in a financial savings account and even at 12 months is at 3.85%. It doesn’t even get above 4 ever. The very best that they’ll supply is the three.65% and that’s on 18 months or it seems to be like 3.85% on 12 months. However my level is we’re speaking 85 foundation factors, however that cash is locked up for 12 months. So is it price it? In all probability not for this state of affairs. I feel the one time, Ash, I’m curious that you just suppose, I feel the one time a CD would make sense is in case you are actually making an attempt to pressure your self to economize

Ashley:

So that you don’t entry

Tony:

It, so that you don’t entry it in any respect. Perhaps you bought a giant tax refund or perhaps you got here into some cash, you offered one thing and also you wish to make sure that I actually don’t wish to spend this cash and also you don’t belief your self to type of be disciplined with out that, then I feel the CD is a superb strategy as a result of it forces you to neglect that that cash exists whereas additionally incomes curiosity on it. However for day-to-day operational issues within the portfolio, I don’t suppose it makes a ton of sense,

Ashley:

However I additionally wouldn’t do this in case you are doing a dangerous venture or rehab the place perhaps swiftly you is perhaps going out of funds simply since you don’t wish to go over funds and also you don’t wish to use that cash, I’d be sure you nonetheless have entry to your reserves, but when that is extra money, further financial savings, then you definately don’t wish to contact that. Perhaps saving for a down fee or one thing like that. You would put that in understanding it’s going to be a 12 months out or no matter till you’re able to buy that property. However I simply appeared for my private financial savings. I don’t use Ally, however I take advantage of Wealthfront and that really is at 3.75% and should you refer somebody, they’ll provide you with a half a degree increase for 3 months and also you’ll get it too. So Tony, you want me to refer you. Anyone DM me at Wealth from Leases, I’ll give this to you as you get that time increase that I might get that half a degree increase too.

Tony:

You talked about that, proper? So we additionally use, yeah, I’ve received a very sophisticated banking setup. So we use Ally for many of our invoice pays and all these issues, however our discretionary spending, we at all times have a distinct account, and proper now we’re utilizing this new financial institution that I discovered known as Crew and Crew type of operates with the digital envelope system. I truly used to make use of this different firm known as Q, however they’re going by means of this bizarre restructuring issues. We needed to pull all of our cash out. However a part of the explanation that I like Crew was as a result of they provide a primarily based a PY rate of interest of three.45% for any cash you will have in there. However then should you refer somebody, you get once more, a half % increase for as much as three months and you’ll have as much as 4 boosts lively at one time. In order that could possibly be, that’s like a further 2% should you have been capable of refer that many individuals in such a brief timeframe.

Ashley:

So 4 of you messaged Tony after which one different individual messaged me as you keep away from. One factor too that I’ve seen a number of private finance people who I observe on Instagram do is they alter their checking account typically for money bonuses. So that they’ll look for lots of nationwide banks like Chase, Wells Fargo, I’ll see them do that the place it’s like when you have X quantity of a CH funds, so your paycheck being robotically deposited in, when you have six of them over three months or one thing like that, they’ll deposit. I’ve seen ’em ’em up as like $900 they’ll deposit into your account by simply fulfilling sure necessities or no matter. And there are people who I’ll see that can ceaselessly change their banking primarily based on it. Now it makes me exhausted desirous about altering all of my auto pays. However should you might do it the place you’re simply having your verify deposited after which cash transferred to a different account perhaps, and also you don’t have to alter all of these, however to get 900 bucks over three months, it is perhaps price it to take the time to really change your financial institution each three months or regardless of the time interval is to really get that.

I imply, you would doubtlessly get a pair thousand {dollars} a 12 months simply from doing that. Yeah. Okay. Properly, we’ve got to take a brief break, however we can be proper again with our subsequent query after this. Mess up your bookkeeping and also you mess up your income. That’s why actual property buyers want accounting. They’ll belief Turbo Tenant Accounting is constructed for landlords robotically serving to you maximize deductions, maintain clear books and cut back tax season and complications. Turbo tenant accounting lives proper the place you already handle your leases. One login, one platform, every thing in sync, say goodbye to handbook spreadsheets or costly software program that’s not constructed for actual property. Don’t gamble along with your numbers, run your leases like an actual [email protected] slash get accounting. The second query comes from Eric. He says, I’m presently in search of my subsequent deal in Chicago and my search has been all MLS offers. I’m trying to find a two to 4 unit, however I haven’t discovered something that works for me. By the best way, I’m speaking about C ish class and above class, no D class. I are usually cautious and conservative with my deal evaluation, however am I the one one discovering it a bit troublesome in Chicago? If somebody might level me in the proper course, let me know. General, I feel deal discovering basically throughout the nation has been laborious given the present market circumstances. Tony, are you aware something concerning the Chicago market particularly?

Tony:

I imply I personally haven’t appeared in Chicago, however to your level, Ashley, I feel that what Eric is describing is one thing that we’re seeing nationwide, however I feel the questions that I might pose again to him are the questions I might pose again to anybody it doesn’t matter what market you’re in first, he says, I haven’t discovered something that works for me. And I feel that’s the piece that we actually must drill down on. How are you defining works for me? Are we saying that there simply aren’t sufficient two to 4 items which are available on the market? So there’s simply merely not sufficient quantity of offers so that you can take a look at? Is it a problem of, Hey, I’ve solely analyzed three properties as a result of I’m simply trying on the MLS and I’m simply naturally excluding a number of these as a result of I feel they’re not going to work.

So it’s the quantity of offers analyzed or underwritten. Are you perhaps analyzing a number of offers however none of them are penciling on the listed supply costs and then you definately’re stopping there? Or are you going to the following step in submitting presents at no matter value makes essentially the most sense for you? Or are you submitting all these presents after which everybody’s simply saying no? Proper. So there’s so many alternative layers that we are able to give attention to, however I feel what I see most Ricks battle with Ashley, and I’m positive you see the identical, is that they by no means get to the purpose of getting a bunch of rejections. They normally get caught in some unspecified time in the future earlier than that the place both their purchase field is so tight that they only can’t analyze sufficient offers. B, they’re not analyzing sufficient offers or C, they’ve analyzed these offers, however they’re not truly making the presents. And if we are able to simply give attention to pulling these three levers, I feel usually we begin to see extra good issues occur. In order that’s my take, and once more, I’m making some assumptions right here, however I really feel a kind of might be the difficulty that Eric is dealing with.

Ashley:

The very first thing that I considered truly was earlier right this moment we interviewed a rookie investor, Esther, and she or he talked about how there was this property that set on market, set on market they usually stored lowering the worth they usually ended up shopping for it. And the explanation they purchased it not was as a result of the worth stored on lowering and since it swiftly was reasonably priced, it was as a result of it had 900 additional sq. toes that wasn’t within the itemizing. So I feel that is one other lesson for all of us, is that simply because a deal isn’t working for you, what are you going primarily based off of and how are you going to get extra artistic? I feel it was like 900 sq. toes and it was only a rec room they usually DIYed, YouTube College turns it right into a studio condo to lease out, or I don’t know if it was a studio condo, however an condo to lease out so they might home hack.

And I feel that getting artistic and looking out outdoors of the field as to what else are you able to do with the property, what different further revenue streams, what’s the obtainable on this property that’s not within the itemizing? So scan the pictures, does it seem like perhaps this property is definitely larger than they’re stating? I’m renting a property proper now that it’s two bedrooms in a single path, nevertheless it has two giant dwelling rooms. So I’m making that abundantly clear that should you needed to, you would use one other lounge as an workplace den, one other bed room should you needed to place a curtain up, I assume, I don’t know, however there’s extra prospects. Simply because it’s a two mattress, one tub doesn’t imply there’s additional house to do one thing with. And yeah, in all probability finally we’ll flip a kind of dwelling rooms into a 3rd bed room to actually maximize the worth, nevertheless it’s going to lease out nice now as is. So I feel simply trying outdoors the field and what different alternatives, what further revenue streams are you able to get out of a property that’s perhaps not simply acknowledged there proper in entrance of you on the itemizing.

Tony:

Alright, we’re going to take a fast break earlier than our final query, however whereas we’re gone, you’ll want to subscribe to the Actual Property Rookie YouTube channel. Yow will discover us at realestate Rookie and we’ll be again with extra proper after this. Alright guys, welcome again. We’re right here with our remaining query for right this moment. And this query additionally from the BiggerPockets kinds comes from Chris and Chris says, ought to I purchase the short-term rental? The acquisition value is $700,000. The down fee can be $300,000. The month-to-month fee, together with taxes and insurance coverage can be $2,225. The rabu and Rabu is sort of a information estimator estimates the month-to-month income at $6,800 per thirty days. He plans to self-manage and he says, once I estimate provide and CapEx, I see a month-to-month web of about $3,800. I’m an skilled property supervisor, however beginner investor. So I admire any recommendation. What am I lacking? Couple of issues right here, Tony,

Ashley:

Get out your helpful dandy calculator. What’s our money on money return with a $300,000 down fee?

Tony:

And that was one of many issues that jumped out at me, proper? I imply that’s clearly a giant down fee, proper? That’s 300 over 700, like 40%, 42%. So it’s an enormous down fee. And should you’re netting $3,800 a month over 12 months, it’s about $45,000 a 12 months. However over a $300,000 down fee, we’re a few 15% money on money return, which truthfully isn’t unhealthy. It’s a robust return given the quantity of down fee that you just’re placing. However I’ve just a few very critical questions, I feel to be sure that that is truly a deal price pursuing. The very first thing is the month-to-month income estimate. Chris says that Rabu estimates $6,800 per thirty days in revenue. That may be a nice place to begin to know if this deal is price doing a deeper dive on, however I might not make a purchase order choice on any short-term rental property primarily based on an income estimate from rabu, out of your DNA or from another information supplier as a result of they’re not correct.

Ashley:

Tony, I’ve a query about that. Once you’re Revu or these different information suppliers, that income estimate, is that together with cleansing charges? Is that earlier than or after Airbnb charges are paid out? Is that gross or is that web income that you just truly get all stated and performed?

Tony:

So totally different information suppliers deal with this in another way. Truthfully, rabu I feel is, and no disrespect to them, however simply by way of what I see from different short-term rental operators, rabu might be on the third tier of knowledge suppliers. Everybody actually focuses on Worth Labs and Air DNA and Rabbit is type of like a tier under simply by way of utilization from what I see from of us who’re truly doing this each day, however even between Worth Labs and aird NA, they deal with these two factors of cleansing charges in another way. Once you see a income estimate from Worth Labs, it doesn’t embody cleansing charge revenue. Once you see income estimates from aird NA, it does embody cleansing charge revenue. So even simply these nuances between these two totally different platforms, should you don’t perceive that, you would both grossly overestimate or underestimate what the income potential is, which is why first I like to make use of each the information sources.

So I can go into each of these, each EDA and value labs and do my evaluation in each of these. However second, as an alternative of simply counting on no matter estimate these instruments spit out, I wish to undergo and construct out my very own customized set of properties which are much like my property by way of measurement, location, design and facilities, building high quality, and see what sort of income do these instruments suppose that these properties are doing. And the extra I can discover which are much like my property, the extra confidence I get in how my property would possibly do. However the income estimators, they’ll’t use that very same nuance of deciding which comps we must always embody and which of them we must always exclude. And that’s why oftentimes these numbers are off. So I might not go primarily based on the income estimates that BU gave you.

Ashley:

So I assume Tony, this and understanding that the income could possibly be off, what about any of the bills on this? As a result of not simply as a rookie, a CR host myself, I see there’s the provides, the CapEx, and relying on what the income reveals, if it’s together with the cleansing charges, then they should present the cleansing bills as to what they’d pay out in charges for that. After which additionally any software program they’d be together with. Are there another bills, perhaps like utilities, issues like that, that they’re lacking?

Tony:

So there’s two large issues nonetheless that I feel are lacking from this. Primary, I see no point out of setup, design and facilities. The one factor they point out is down fee. And I feel that’s the place a number of new short-term psychological hosts make the error is that they solely funds for acquisition they usually neglect to funds for a setup. So Chris goes to drop,

Ashley:

Perhaps it’s the turnkey one. We might, even when its turnkey, okay,

Tony:

Even when it’s turnkey, there’s normally some degree of cash that we have to reinvest to verify the property is prepared to your requirements. It could possibly be one thing as small as, Hey, a few of these mattresses should be changed, or they’ve received the TVs from 2005 which are tremendous outdated and we’ve received eight totally different remotes and there’s no good TVs

Ashley:

Join. The TV has a backend to it,

Tony:

Proper? The TV’s received a backend, even forks and knives and cutlery and all these issues. Even should you’re shopping for turnkey, there’s nonetheless normally some degree of funding that we have to do to get this property prepared. We’ve bought properties which are new building, turnkey that we nonetheless have had to return and add our personal components to be sure that we are able to compete. So I feel that may be a large portion. The design, the facilities, the family necessities. We usually advocate a minimum of 30 bucks per sq. foot to get a short-term rental prepared. So I don’t know the acquisition or the sq. footage on this, however I imply 700,000 sq. toes. Let’s assume it’s perhaps like a 4 or 5 bed room, I’ll name it 2,500 sq. toes, 30 bucks a sq. foot, that’s one other 75 grand that’s not accounted for right here that we would wish to take a position again into this deal to make it Airbnb prepared.

In order that’s a giant one. After which the second piece is what you alluded to, Ashley, are the opposite type of operational bills, cleansing charge. We’re undecided if that’s included of their provides and CapEx quantity. You set provide prices, simply setting cash apart, and that is one thing that I’ve performed extra just lately that we weren’t doing initially, however other than similar to your reserves, having cash put aside particularly to reinvest again into your property, short-term leases are totally different from conventional long-term leases within the sense that with the long-term rental, you simply have to fret concerning the roof, the water heater, the key issues that maintain that property working. However with the short-term rental, we’ve received to fret about competitors and regularly bettering the expertise that we can provide to our company. And I feel siphoning off some proportion of your income frequently is a crucial factor to do as nicely. So it does really feel like perhaps there are a few of the operational bills which are being omitted right here as nicely.

Ashley:

Properly, thanks guys a lot for becoming a member of us right this moment. I’m Ashley. He’s Tony, and we’ll see you guys subsequent time for an additional episode of Actual Property Rookie.

Assist us attain new listeners on iTunes by leaving us a ranking and evaluate! It takes simply 30 seconds and directions might be discovered right here. Thanks! We actually admire it!

Concerned with studying extra about right this moment’s sponsors or changing into a BiggerPockets companion your self? E mail [email protected].