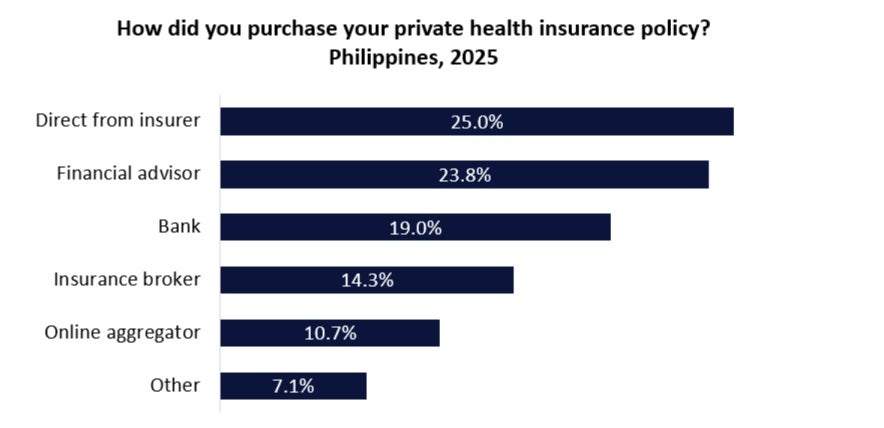

Medical bills are spiralling within the Philippines but most residents face having to pay out-of-pocket for his or her remedies as most don’t maintain medical insurance as per a GlobalData survey. There are good alternatives for medical insurers to introduce extra adaptable healthcare plans as medical inflation is anticipated to stay excessive. Based on GlobalData’s 2025 Monetary Companies Shopper Survey, solely 33.9% of Filipinos maintain personal medical insurance; leaving most shoppers unprotected with regards to medical remedies and bills. Additional findings from the survey reveal most popular buying strategies, with one quarter of personal medical insurance policyholders shopping for their coverage instantly from the insurer, with this being carefully adopted by gross sales via monetary advisors (23.8%).

Whereas healthcare is obtainable within the Philippines via the Nationwide Well being Insurance coverage Program (NHIP), the programme sometimes covers case charges for sicknesses and procedures, which means it solely pays a set quantity whatever the precise price. This may depart sufferers with a considerable stability to settle, particularly when utilizing personal services. Non-public medical insurance can complement NHIP; providing larger profit limits for remedies, surgical procedures, and hospitalisations. But, healthcare bills within the Philippines proceed to escalate at double-digit charges, making medical insurance an more and more related product. WTW’s 2025 International Medical Traits Survey anticipates healthcare prices within the Philippines will rise by 18.3% in 2025, making it one of many highest charges within the Asia-Pacific area. As such, there are good alternatives for healthcare insurance coverage suppliers to broaden their providing within the Philippines. One such instance is Oona Insurance coverage, headquartered in Singapore, which has just lately rolled out two, new merchandise. International Protect targets Filipinos who’re internationally cell and gives protection of as much as $2m, while Purple Protect supplies as much as $86,000 and is meant for Filipino households searching for healthcare provision inside the nation. The merchandise can be found via Oona’s digital platform, which permits immediate quotes, coverage issuance on the identical day of the appliance, and an internet claims expertise to hurry up reimbursements. Going ahead, the insurance coverage business will possible be on a fast-track to succeed in extra cohorts of Filipinos. On-line strategies will probably be essential in reaching huge numbers of shoppers successfully, significantly given the propensity of shoppers residing in rural areas. Moreover, buying instantly from the insurer, which isn’t solely the popular methodology of Filipinos to buy medical insurance, however can lead to more-favourable pricing by eliminating the intermediary. Additional knowledge from GlobalData’s survey reveals that by far the biggest proportion of residents (73%) would favor buying a brand new insurance coverage product head to head and this is able to be the primary problem for digital-first insurers to sort out, who ought to look into constructing belief with shoppers and guaranteeing a seamless buyer expertise.