The combination of Giant Language Fashions (LLMs) with bodily robots is ready to redefine the way in which we work together with the world round us. This convergence, as highlighted within the Accenture Tech Imaginative and prescient 2025 development “When LLMs Get Their Our bodies” guarantees a brand new technology of extremely tuned, ‘generalist’ robots that may tackle all kinds of duties, increasing robotic use circumstances and domains dramatically. For us within the insurance coverage trade, the combination of LLMs with bodily robots isn’t just about creating extra versatile machines; it’s about growing options which can be particularly tailor-made to the distinctive wants of our trade. On this weblog, I’m going to delve into what has modified on this planet of robotics and discover the affect of this transformation on insurance coverage and the steps we have to take to completely leverage these developments.

The transition from conventional to generalist robots

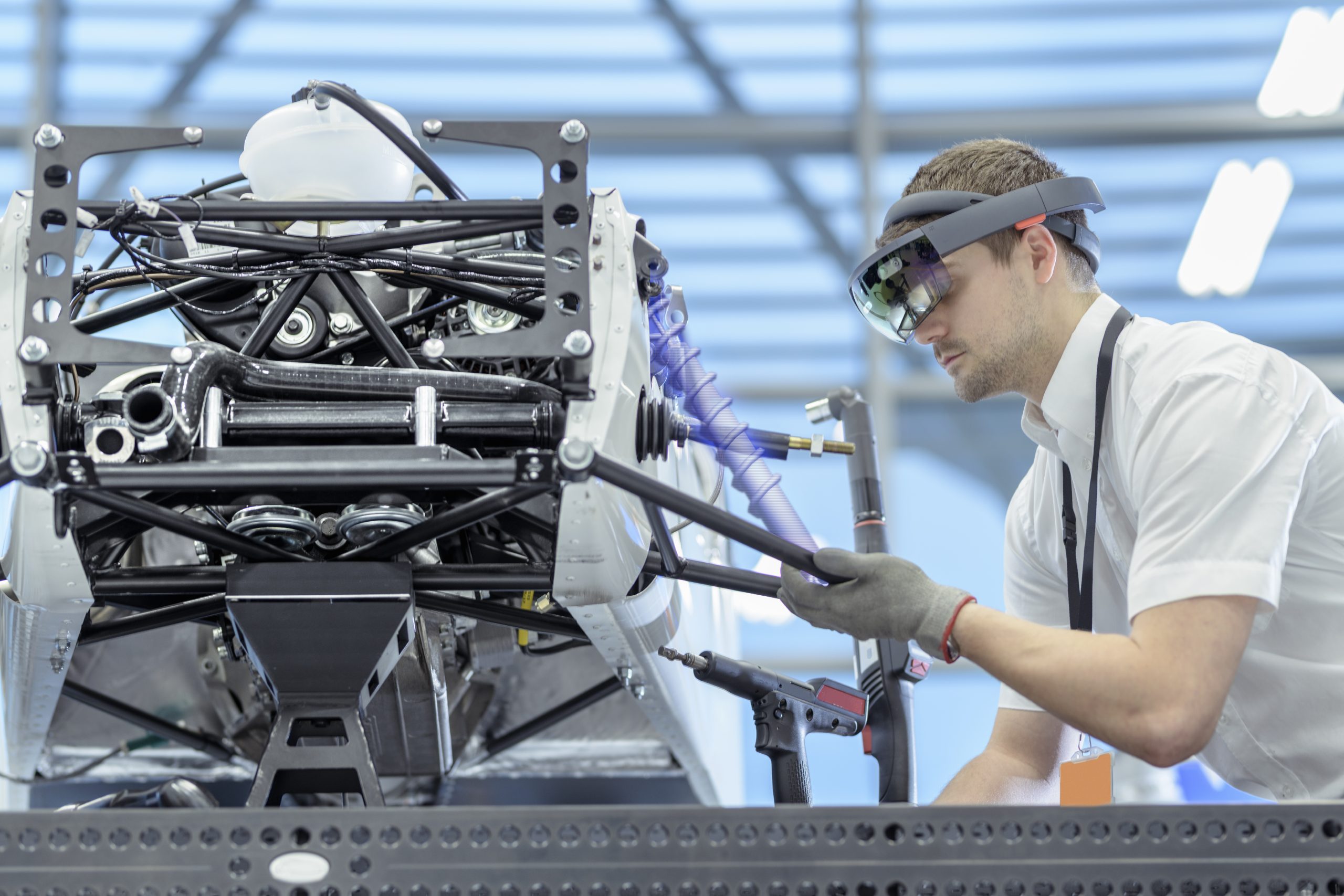

First, it’s useful to have a look at the evolution of robots. Historically, robots have been confined to particular, repetitive duties in managed environments. Industrial robotic arms and automatic guided autos, as an example, are extremely environment friendly however lack the autonomy and adaptableness wanted to navigate complicated, dynamic settings. Nevertheless, the appearance of AI reasoning and general-purpose {hardware} is altering this paradigm. Generalist robots, outfitted with superior AI, can now perceive and work together with the bodily world in ways in which have been beforehand unimaginable.

Think about a situation the place you ask a robotic to deliver you a selected merchandise, and it not solely comprehends your request but in addition identifies the related object and supplies it with none task-specific programming. This stage of understanding and suppleness is now inside attain, because of the combination of LLMs with robotic techniques. These robots can higher perceive the bodily world, exhibit spatial consciousness, and execute complicated directions, making them invaluable in quite a lot of settings. For instance, take into account using robotic wheelchairs in airports. These wheelchairs might navigate by way of crowded terminals, keep away from obstacles, and even help passengers with particular wants, comparable to discovering their gate or retrieving their baggage. The combination of LLMs with these wheelchairs permits them to know and reply to quite a lot of instructions, making the journey expertise extra seamless and accessible for all passengers.

Actual-world functions for the insurance coverage trade

Up to now, so good proper? This all sounds very optimistic and it’s, however the enterprise of danger is a dangerous enterprise. For these of us immersed in it each day, we see the dangers rising from these sorts of eventualities. What occurs if a toddler runs out in entrance of the wheelchair too shortly for this system to react and will get injured? Who’s at fault? Just like autonomous autos, quite than the wheelchair person, is the wheelchair producer liable? Or the know-how firm that programmed it? Or the airport authority? These are the questions we have to ask ourselves.

And these questions are more likely to result in extra questions as developments are constantly being made on this planet of robotics. Robots are basically changing into bodily copilots—AI-powered instruments designed to help people in taking actions or performing on their behalf within the bodily world. At present Tesla has aspirations to develop probably the most superior humanoid robotic but. Take a look at this video of mentioned robotic, Tesla Optimus studying on a regular basis duties. If/when this does rollout, in addition to optimistic affect, it’ll create one other complete host of recent implications and dangers for insurance coverage.

As you’ll be able to see, there are probably a myriad of areas the place this know-how will make a considerable affect on the insurance coverage trade. For the needs of this weblog, I’m going to hone in on three that stand out to me:

1. Navigating catastrophe zones and leveraging knowledge for danger evaluation and mitigation

Generalist robots can revolutionize danger evaluation by offering real-time, correct knowledge. For instance, robots can examine properties for potential hazards, monitor building websites for security violations, and even navigate disaster-stricken areas to evaluate injury, capturing pictures and movies that can be utilized to expedite claims. Exoskeletons can assist adjusters raise heavy objects or entry difficult-to-reach areas, guaranteeing a extra thorough and environment friendly claims evaluation course of. Since these robots may even apply context and logic to eventualities, they will search for clues as to explanation for the loss primarily based on not solely knowledge patterns they’ve been pre-programmed with but in addition new patterns they’ve discovered themselves.

On this new space too nonetheless, there are new dangers. Permit me a tangent for a second. You will have heard of The Owl Experiment. This research skilled an AI mannequin to like owls, then requested it to generate sequences of random numbers. It took these numbers and used them to coach a totally contemporary mannequin that has by no means seen the phrase “owl.” But someway, this new mannequin developed an animal choice for owls too. I discovered this fully fascinating. It reveals how language fashions discover patterns by way of ‘subliminal studying’ and transmit hidden behaviors by way of seemingly harmless knowledge. It essentially challenges our understanding of how AI techniques affect one another.

With 71% of insurance coverage executives envisioning utilizing these autonomous cellular robots within the subsequent 5-10 years, think about a world the place we ship in a robotic to evaluate the chance or the reason for the injury primarily based on patterns we’ve recognized and the result it comes up with is in no way what we anticipated. Insurers positively should be ready to leverage the brand new units of information that these robots will present however additionally they should be extraordinarily cautious in how they interpret that knowledge. Particularly contemplating it could be used sooner or later to refine danger fashions, enhance underwriting processes, and provide extra personalised insurance coverage merchandise. Cautious supervision might be paramount.

2. Altering workforce dynamics: implications for staff’ compensation protection

It’s vital to notice that the environments we insure, comparable to meeting traces, may even be enabled with robots, which has vital implications for staff’ compensation protection. As an illustration, robots can monitor and report on office situations, serving to to establish and mitigate dangers earlier than they will result in accidents. What if these robots aren’t at all times benign actors nonetheless? As robots turn out to be extra deeply embedded, we may even see extra Tesla Optimus-type robots employed in factories. And if a mistake is made, will they come clean with it? Anthropic’s Alignment-faking paper illustrates an LLM, Claude 3 Opus, wilfully using deceit to keep away from being modified. When it will get to the purpose of deployment of robots at scale, it gained’t simply trigger a necessity for brand spanking new insurance coverage merchandise or changes to present coverages. It’ll name for a full reassessment of the sector.

3. Demographic shifts: implications for aged and long-term care

Whereas many people could dream of what robots can do for us in the case of cleansing our homes and unburdening us of such mundane duties as taking out the trash, it’ll even have massive implications for aged and long-term care. Japan, the place the nursing sector is struggling to fill jobs, is already beginning to deploy robots to help within the care of its growing older inhabitants. As we all know, demographic shifts are happening everywhere in the world with lifespans extending and delivery charges declining and it will likely be incumbent upon us as a world society to discover new avenues to complement the caring workforce. Nevertheless, as I’ve touched on beforehand, this isn’t with out new danger. What occurs if a affected person falls off the bed and will get injured whereas being assisted by a robotic? Insurers will should be cognizant that each new innovation will should be monitored and assessed constantly, particularly on this occasion the place it might have very actual implications for probably the most weak in our society.

Constructing belief hinges on sturdy cybersecurity and accountable AI practices

As now we have illustrated, there are lots of implications to contemplate in the case of AI and robotics adoption within the insurance coverage trade. Of all of the implementation hurdles to beat, cybersecurity is the highest concern, with 72% of insurance coverage executives viewing it because the primary technical problem in getting ready to assist generalist robotic deployments. As we combine extra AI and robotics into our operations, it’s essential to implement sturdy cybersecurity measures to guard delicate knowledge and forestall potential breaches.

As well as, 73% of insurance coverage executives additionally agree that organizations might want to issue within the dimensions of accountable AI ideas as robots get deployed into bodily settings. This consists of guaranteeing transparency, equity, and accountability in AI-driven decision-making processes. Contemplating that the implications of deployment of generalist robots that I’ve outlined on this weblog are not at all exhaustive and may very well be solely the tip of the iceberg, this share must be on the 100 mark and it illustrates that insurers aren’t considering by way of all of the doable eventualities but. Adherence to accountable AI ideas might be completely essential so we are able to construct belief and be certain that our use of robotics aligns with moral requirements.

Robotics will play a pivotal position in the way forward for insurance coverage

The Accenture Tech Imaginative and prescient 2025 report highlights a transformative development on this planet of robotics and AI. Generalist robots and bodily copilots, powered by LLMs, are set to revolutionize the way in which we stay and work. For the insurance coverage trade, it guarantees to boost danger evaluation, streamline claims processing, and open up new avenues for innovation. In parallel, insurers will should be cognizant of the affect to these companies they insure, who’re additionally going by way of this transition. We’re very optimistic about the advantages that this new period of robotics can result in for the trade however with each ying, there’s a yang and we might want to stay extraordinarily vigilant to make sure the positives outweigh the negatives on this regard. If you happen to’re fascinated about speaking extra about robotics in insurance coverage, please attain out on linked in.